Voting for Change – Some Comments

I received an email that was a composite of three other emails, apparently, collected together into one grand statement concerning the consequences of the 2006 Election results. Due the large amount of 'data' presented in these collected emails, I am going to limit myself the what was contained in the first email only, in this response. This email attempted to credit virtually everything negative that has happened and all bad economical statistics to the results of that election. There are many fallacies in this email including bad logic, bad data, lying with statistics not to mention a purposeful intent to mislead the ignorant.

First an appeal to logic. There is a logical fallacy called post hoc ergo propter hoc which means, translated from Latin, 'after this, therefore because of this'. This is the way it works:

1) A occurs before B

2) Therefore A is the cause of B

This is a fallacy when there is no proven connection between the two events to support a claim that A caused B. The mere association of one event occurring before the other proves nothing.

Snopes, which is known as unbiased source who researchs emails, urban legends, and such items floating around the web, has determined that this email is false. Their first point was that, saying that because election occurred first and then bad things occurred in the economy, is a case of the logical fallacy explained above, since no proof of a causal factor was given. Only that the events happened one after the other.

Secondly, the Snopes piece points out that actually its not a Democratic Congress, per se. They gained 31 seats in the House giving the Dems a 233-198 majority, but the Senate currently has 49 seats for each party - a deadlock.

Thirdly, Snopes makes the point that the currently economic situation was obviously the result a large number of complex factors many of which have been developing over a period of many presidential terms, and which lie completely outside the realm of Congress. For example, the rise of the housing debt whose bubble broke in 2007 could be traced all way back to practices starting in the 80's. To assume that the actions or inactions of Congress suddenly created the severe economic, largely mortgage/bank based troubles, we saw mid 2007 is ridiculous and only shows complete ignorance of our economy. There is a brief analysis of how the economy got where it was in the Snopes article, extracted from a 2008 book by Kevin Phillips.

But this email, Voting for Change, insulted my intelligence to such an extent I felt it necessary to personally research these topics and fill the void of ignorance with more actually data on the trends and origins of the economic factors mentioned.

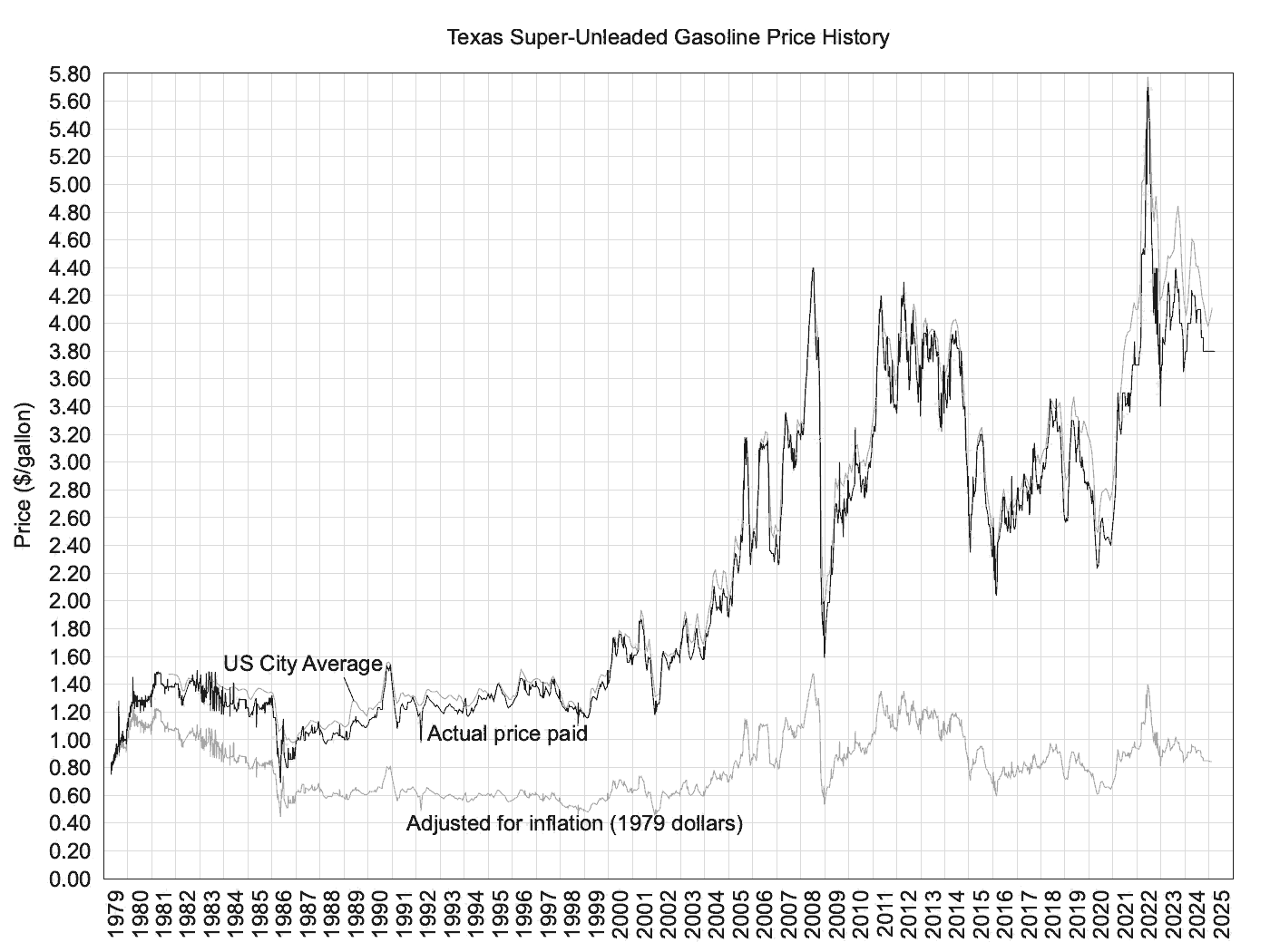

First, lets look at gasoline prices. Check out the following chart:

It is obvious that the trend of higher prices start around the beginning of 2002. There was no change in the trend at the end of 2006. In fact, if you look closely the rate of ascent decreased slightly. The main idea to absorb from this graph is, however, the upward trend in prices started long before the end of 2006.

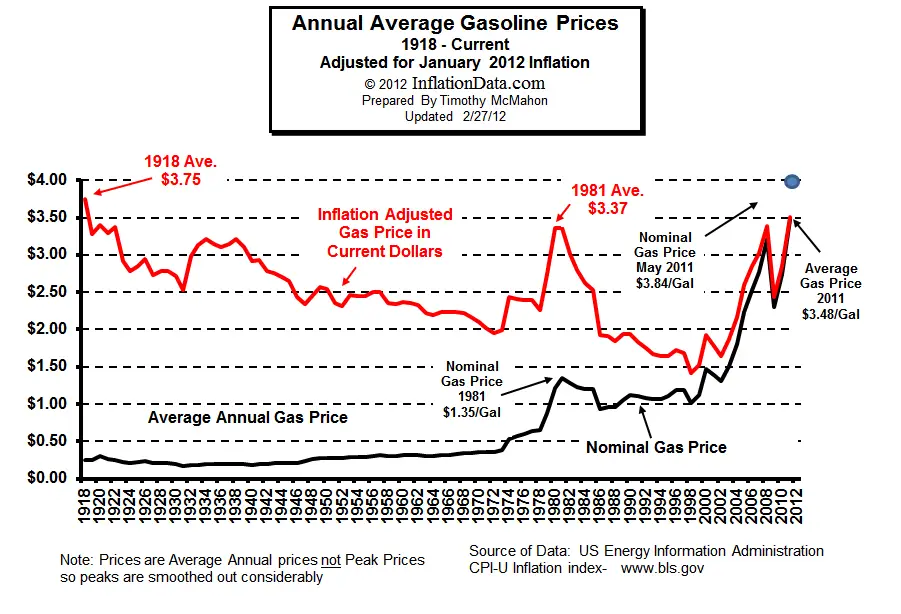

The next thing to take into account is the price of gas adjusted for inflation:

Notice that adjusted for inflation, the prices of gas haven't really gone up that much. What this really points out is that the real problem is the devaluation of the dollar.

Another graph that points out this situation is:

The red line is the cost of gas adjusted for inflation. Interesting points here are that current uptrend in prices started in 2002, and that inflation adjusted the prices are about the same as they were in 1981.

The really important data to look at concerns the value of the dollar:

The points to notice on this graph are, first that the downtrend started at the beginning of 2002. Second, that by the end of 2006, the trend was well underway and just continued on. Third, and most important, there has been a 40% loss of value of the dollar since 2002. Translated into practical terms, that means that if you had $100,000 in your Pension fund in 2002, you now only have the spending power of $60,000. You effectively lost $40,000. Good thing you are getting back your $600 this year, eh?

So, the main item of concern then becomes, how did the dollar lose its value? Here are the basic economics of the situation in a nut shell. We have a money system (Fed) where money is created by creating debt. The more debt that is created the more money goes into circulation. Then there is supply and demand. The more paper money that floats around used to purchase the same amount of produced goods to consume, the less the paper money is worth. Program for disaster: create massive amounts of debt, for example through federal spending, and pump huge amounts of paper money into the economy and the money eventually becomes worth less. This does not happen immediately. At first the extra money may create an artificial boom. Next, the money on international markets becomes worth less. Then, in the end the excess paper money comes home to roost in the domestic economy. Then the same dollar buys less and thus is devalued. This cycle can take years. So with the biggest national debt in the history of the nation, it is not hard to see how our dollar got devalued by 40%.

Next, let's look at the Consumer Confidence statistics:

Notice that the major decline came starting in 2001, and hit bottom in 2003. Also, on the other hand, there was a steep increase in Consumer Confidence from 1992 to 2000. Can we conclude these statistics are related to elections? No. More likely tied to other economics factors of a more complex nature.

Moving on to the next statistic mentioned in the email, the Unemployment rate:

Of note here is the fact that unemployment rose steeply in 2001, peaked in 2003, stayed steady for a while after 2006 then rose a bit again. It is now at the levels it was before 2000. So, if elections are attributed as a cause then the 2000 election caused a huge rise in unemployment . However, the real cause it probably related to the more long term economic factors discussed elsewhere.

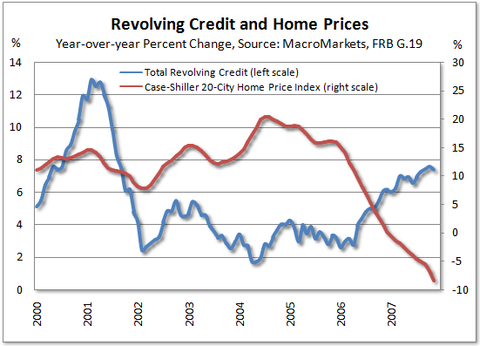

Concerning equity values, I am not sure where the overall loss of equity figure came from since there was no source given. But the only reasonable guess would be the stock market combined with real estate losses. On the part dealing with stocks, it is absurd to believe the election had anything to do with the sudden, unexpected crash of the stock market in August of 2007. This had not only many economic factors, but high-rolling speculators in who knows what Ponzi scheme investment ventures involved. So I will look at the slightly less speculative area of home equity values:

This chart clearly shows that the downtrend in home prices started in 2004. As has been mentioned all over the media, this bursting of the real estate bubble involved shady mortgages, extended credit, shady bank created investment packages and a host of other factors. But this was all in the works for many years before it all exploded last year.

Finally, there are no specific legislative bills mentioned which the Dems passed that caused any of the down statistics, even if it did occur in a timely fashion, and there is no mention of the idea that Bush could have vetoed (he is very fond of vetoing bills) any of these imaginary democratic bills.

All in all, it was a pathetic mis-guided effort of some die-hard Bush supporter who hasn't realized that the Republican Party today no longer represents true Conservative values. I might mention that being more conservative than liberal in my politics, though I think the two party system is dead, I voted for Bush in 2000. It took me about a year to realize I had made a mistake, and that he wasn't truly a Conservative. Neocons have much different agenda that true Conservatives. Conservatives believe in small governments, tight budgets, more individual liberties, a non-aggressive foreign policy, and less government control in our lives. The current administration has acted in the exact opposite direction to all these Conservative values. The government has grown in size, we have the largest budget in the history of the nation, we have the biggest national debt in the history of the nation, there has been a massive deterioration of civil liberties and violations of Constitution, we have a foreign policy very similar to Nazi Germany, and the federal government intrudes in our personal lives more than ever before in our history. No I don't like Clinton, and Bill was a sleazebag, but let's not get into a whole other type of logical fallacy. That doesn't by default mean that what we have now is good.

0 Comments:

Post a Comment

<< Home