There is something going on in our United States that it seems that has slipped the attention of all but the most astute observers. In so many words, it might be said the value of the U.S. Dollar is going to Hell in a Handbasket. Here is a chart:

On the other hand, Gold has been correspondingly rising in price since 2001, and is in fact near an all time high. It has gone from about $250/ounce to over $700/ounce. This of course is no co-incidence. There are at least two ways of looking at this. As confidence in the dollar deteriorates people, and governments, tend to store their wealth in something of more lasting value. Also, Gold has been the stable commodity and store of value for 1000’s of years. One might consider that Gold hasn’t really changed in value but it is just the Dollar losing value relative to it. Here is a Gold Chart:

What is insidious about this is that the devaluation of the dollar cuts the spending power of U.S. citizens and decreases the value of their savings. The Federal Reserve and the Government have a coalition to spend money they don’t have and run up debt. Paper money is spun off the printing press to cover it, out of thin air as it were. Interest is made on the money. Putting more dollars into circulation chasing the same goods devalues the worth of the dollar.

An interesting way to look at the stock market is to consider that Gold has the same value as it did 5 years ago and see what would happen if we valued it in gold instead of dollars. For example, what if the S&P 500 Index of stocks were valued in gold instead of dollars. Here is what the chart would look like:

Notice that in these terms the so-called partial recovery of the Stock Market is really non-existent.

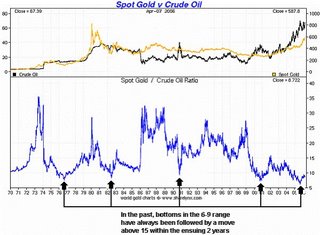

Another very revealing statistic to look at is the price of oil valued in Gold. Here is a chart of the price of Gold relative to the price of Oil:

What this shows is that the price of oil really hasn’t gone up particularly. The oil producers would be getting robbed if they didn’t demand more dollars since progressively the dollars they were getting had less value.

What this all points to is an impending economic crisis of drastic proportions. It is not hard to extrapolate how the real value of homes has been doing over the last 5 years, for example, in terms of Gold. The real effects of this devaluation are just beginning to be felt in many segments of society.

While we many not be able to get rid of the Federal Reserve right away, we can send a message to our Congressmen that we don’t want the government spending money they don’t have and worsening the situation. If the government would run a balanced budget and starting reducing the debt this would be a good first step. Then perhaps some day we could grapple with pulling the culprit out by the roots.

References

http://www.house.gov/paul/tst/tst2006/tst051506.htm

http://mises.org:88/Fed

I owe suggestion of many concepts about calculating gold ratios to Jim Dines and The Dines Letter, http://www.dinesletter.com/